If the Fed set out to destroy the monetary system, they’re really near completing the job.

If you set out to ruin markets and the financial system, your essential weapon is moral danger, the disconnection of threat and consequence. You disconnect threat from repercussion by rewarding those making the riskiest bets and bailing out bettors whose bets spoiled.

You reward those making the riskiest bets by pressing markets greater no matter any other factors. Nothing matters other than your support of ever greater markets.

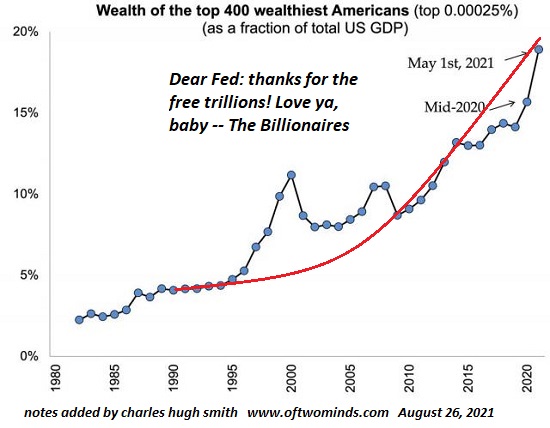

This implicit warranty that any bet on markets lofting greater will be a winning gamble benefits those making the riskiest bets. The punters who played small with cash made a few bucks, but the punters who obtained greatly and after that leveraged those bets to the hilt made a killing.

To put it simply, moral danger incentivizes taking full advantage of debt and take advantage of to increase the danger and size of bets since every bet is a can’t-lose proposition. The reluctant, the mindful, the sensible, those who hedge their riskiest bets, are all left in the dust. Anyone who does not max out borrowing and leverage is a loser.

By pushing markets ever higher, you bail out every individual. To comprise any losses, all the punters need to do is increase the size and threat of their next bet.

To ensure everybody is properly incentivized and guaranteed, you bail out the most significant bettors should they somehow lose. You do this by using them unlimited credit lines (so they can take advantage of up their next bet and win back their losses), you eliminate transparency in market pricing to mask their losses (eliminate mark-to-market requirements, and so on) and you ignore fraud, racketeering, price-fixing, collusion and embezzlement since all these activities serve to increase risk-taking and delegitimize markets.

The greatest bettors understand they can actually do anything and get away with it, and so they do literally everything that undermines markets and trust: there’s no limitations on fraud, racketeering, price-fixing, collusion and embezzlement, those summoning the most innovative frauds and scams are the most highly rewarded.

The Moral Danger Beast will now completely damage markets and the financial system, simply as you meant. Every participant will continue pyramiding debt, take advantage of and threat due to the fact that they understand you’ll keep markets lofting greater despite any other condition: they will follow “flows” (i.e., what other punters are buying at the minute) and ride those circulations greater, completely confident that you will never ever let markets decline by more than signal-noise dips that offer punters a fresh chance to leverage up another bet on greater markets next week and next month.

Your plan is creative due to the fact that the punters are all so concentrated on optimizing their own gains they do not see that the debt, leverage and danger now dwarf everything else. Having ensured that the riskiest, most leveraged bets will be the greatest winners, financial obligation and utilize have actually blown up greater. The whole monetary system is now based on the riskiest, most leveraged bets continuing to pay out even as they overshadow the rest of the financial system.

Your plan depends on the mispricing of threat: by implicitly guaranteeing every punter betting on a greater market next week or month will be a winner, you’ve decreased apparent risk to near-zero. What’s the risk if everyone knows markets will loft higher regardless? There is no danger, so forget it; hedging risk simply minimizes your net earnings.

But since danger isn’t extinguished, it’s just moved, the question ends up being: where did all the risk end up? Answer: in the monetary system itself. All the threats accumulating as trillions of dollars are leveraged into ever larger can’t-lose bets have not vaporized, they’ve been transferred to the monetary system. So when threat exceeds the bring capacity of the system, it will be the system which implodes, not just punters’ riskiest, most highly leveraged bets.

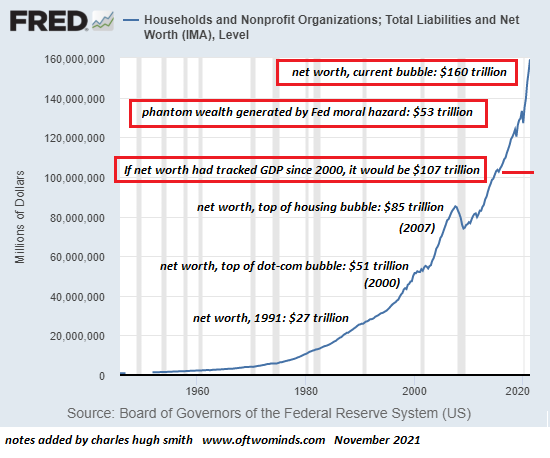

Here is a chart of family net worth over the past 70+ years. (Yes, it consisted of not-for-profit companies, that make up a modest portion of the overall.) Keep in mind the 3 bubbles inflated by Federal Reserve policies: the dot-com bubble in 2000, the real estate bubble in 2007 and now the Whatever Bubble in 2021.

If net worth had tracked GDP development given that the peak of the dot-com bubble in 2000, it would have to do with $107 trillion–$53 trillion listed below current bubblicious levels. This can be comprehended as $53 trillion in phantom wealth generated by leveraging up the Federal Reserve’s $8 trillion growth of its balance sheet given that 2008 seven-fold.

This extremely leveraged phantom wealth will evaporate as soon as the system can no longer include all the threat that’s been accumulated by the Fed’s Moral Threat Monster.

When $50+ trillion of phantom security evaporates, the entire pyramid of financial obligation and utilize will collapse, destroying the entire monetary system.

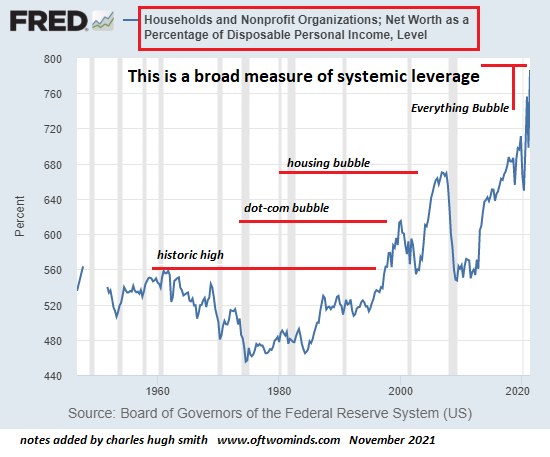

One broad measure of the take advantage of that’s been piled up in the Fed’s moral threat free-for-all is net worth relative to non reusable personal earnings which is the ultimate security for the financial system, as all financial obligation service and consumption is paid of earnings.

Note the vast growth of utilize in each bubble. Leverage in the Whatever Bubble has blown past every previous extreme.

If the Fed set out to destroy the monetary system, they’re really near to finishing the job. Their Moral Threat Beast will lay waste to phantom collateral and whatever that’s been borrowed and leveraged versus that phantom collateral. Thanks to the Fed’s Moral Danger Monster, financial obligation, take advantage of and threat now far surpass what the system can support.

Forecasting the bottom is tough when the system collapses. Historically, a go back to 400% of non reusable individual income would be a sensible guess. If non reusable income craters, net worth will change accordingly.

< img align ="center"src=" https://www.oftwominds.com/photos2021/net-worth-income11-21a.png "/ > If you found value in this content, please join me in seeking options by ending up being a $1/month patron of my work by means of patreon.com.

My new book is readily available! A Hacker’s Teleology: Sharing the Wealth of Our Shrinking World 20% and 15% discount rates (Kindle $7, print $17, audiobook now available $17.46)

Read excerpts of the book for free (PDF).

The Story Behind the Book and the Introduction.

Current Videos/Podcasts:

Keiser Report|The Tragedy of the Treadmill (25:30)

My current books:

A Hacker’s Teleology: Sharing the Wealth of Our Shrinking World (Kindle $8.95, print $20, audiobook $17.46) Read the first section free of charge (PDF).

Will You Be Richer or Poorer?: Revenue, Power, and AI in a Shocked World

(Kindle $5, print $10, audiobook) Read the first area totally free (PDF).

Pathfinding our Destiny: Preventing the Final Fall of Our Democratic Republic ($5 (Kindle), $10 (print), ( audiobook): Check out the very first area free of charge (PDF).

The Experiences of the Consulting Thinker: The Disappearance of Drake $1.29 (Kindle), $8.95 (print); read the first chapters for free (PDF)

Money and Work Unchained $6.95 (Kindle), $15 (print) Check out the first section totally free (PDF).

End up being a $1/month customer of my work via patreon.com.

KEEP IN MIND: Contributions/subscriptions are acknowledged in the order received. Your name and email stay private and will not be provided to any other specific, company or agency.

|

Thank you, Rod G. ($54), for your marvelously generous contribution to this website– I am significantly honored by your support and readership. |

Thank you |

, Gonza T. ($5/month), for your splendidly generous promise to this website– I am greatly honored by your assistance and readership. |

|

Thank you, Robert D. ($5/month), for your magnificently generous pledge to this website– I am greatly honored by your support and readership. |

Thank you |

, Louis J. ($5/month), for your magnificently generous promise to this site– I am significantly honored by your support and readership. |