You can see why Joe Biden’s pals wish to blame Russia for U.S. inflation.

The American public’s approval of Joe Biden’s handling of the economy slipped a notch lower in February, according to the latest Gallup poll. It’s like someone has actually put a neon sign flashing #BIDENFLATION on the White House lawn.

Now they’re rushing everyone, trying to end. But this method of blaming Putin probably will not work for a simple reason: inflation was already soaring.

Simply 37 percent of Americans stated they authorize of Biden’s handling of the economy, below 38 percent in November, 46 percent in August, and 54 percent a year ago. Sixty-two percent say they Biden’s handling of the economy.

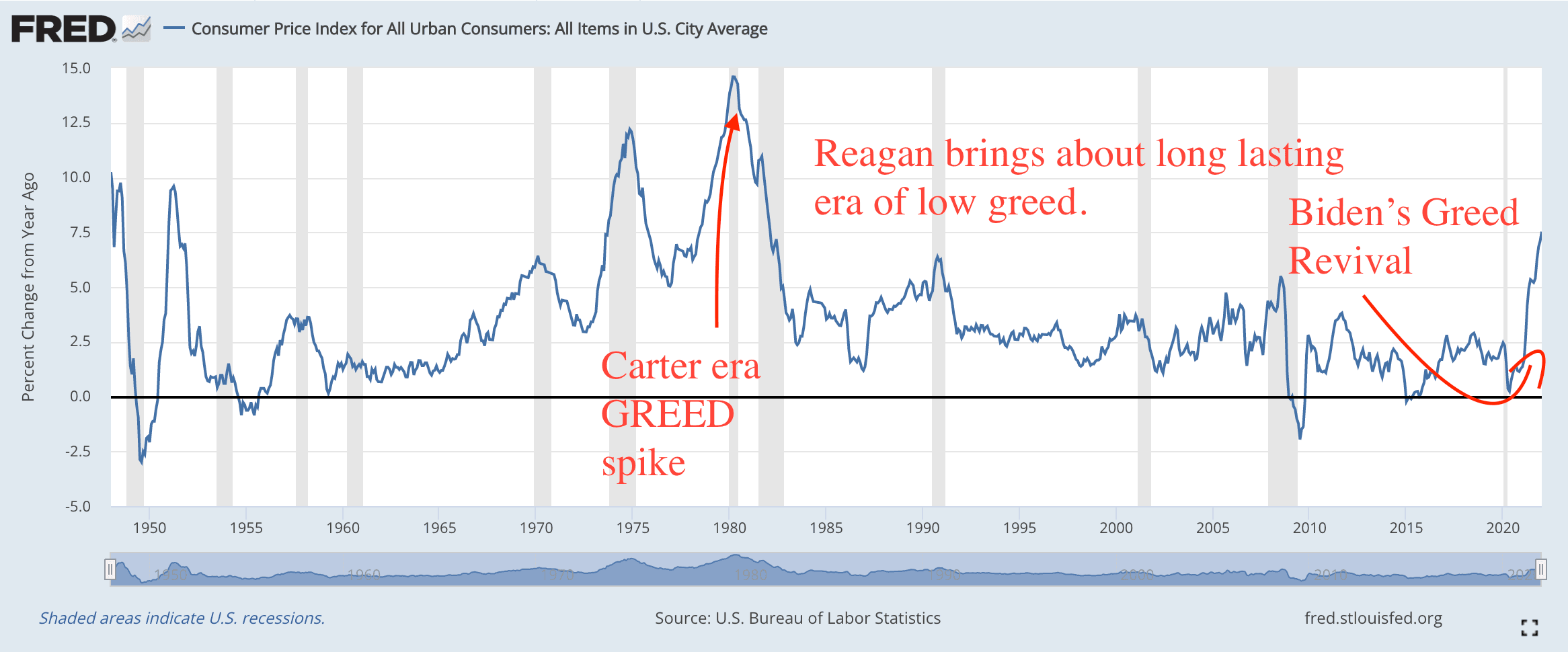

Inflation increased greatly in 2015 and has actually continued to climb this year. In January, the Consumer Price Index struck its fastest rate of inflation in 40 years.

Biden and his White House lost the self-confidence of the public by minimizing inflation and declaring it was most likely to fall back down to bearable levels. The Biden administration likewise attempted to pin the blame on inflation on corporate greed, a scapegoating that attracted the mockery of financial experts and failed with the American public who doubted that corporations had suddenly experienced a rise in greed after Biden’s election.

Did the Biden Greed Rise Cause Inflation? Now the Biden administration and allies in the media are declaring, wrongly, that rates are high due to the fact that of the conflict over Ukraine.

The U.S. economy has actually been struck with increased gas prices, inflation, and supply-chain problems due to the Ukraine crisis. https://t.co/d9dwXWpcvf

— CBS News (@CBSNews) February 23, 2022

The conflict could push up prices of oil and gas, in addition to wheat and some agricultural products, however those costs were currently rising long prior to Russia’s latest carry on Ukraine. The price of oil had actually climbed up high enough last year, for instance, that Biden purchased an extraordinary peace-time release from the Strategic Petroleum Reserves. The greatest jumps in inflation took place in 2015, when the Customer Rate Index leapt dramatically in the spring and once again in the fall.

The conflict is most likely to have just a temporary effect on the price of gas here in the U.S., presuming it does not escalate into a full-scale war. If the U.S. imposes an embargo on Russian oil, for example, that oil will be offered in other places. The oil displaced by the influx of Russian oil will be offered into the U.S. Oil is not totally fungible but it is fungible enough to enable alternative in the international market. For instance, we utilized to purchase great deals of oil from Venezuela. When we stopped, we started importing more from … wait for it … Russia. The procedure will not be instant and rates will likely jump at first but those interruptions really will be transitory.

The blame-shifting on inflation might backfire because the general public already believes Biden made a mess of relations with Russia. In August of 2021, the approval ranking for Biden’s handling of Russia was at simply 39 percent. But in February, it was up to 36 percent.

Inflation was brought on by a liberal monetary policy supporting excessive deficit spending as America emerged from the pandemic economic crisis. It has actually continued, in part, since the Biden administration keeps attempting to spend even more cash and insists on putting forward implausible strategies to lower their effects on the deficit with accounting gimmicks.

With any luck, inflation will pull back in the not-too-distant future thanks to the death of Build Back Better, a Fed prepared the aggressively tighten up, and a rebalancing of political power on Capitol Hill next year that will ensure the general public that Biden’s huge costs days are dead.