Now that the United States economy is totally depending on trillions of dollars in stimulus and speculative gains reaped from the stimulus, there is no Genuine Economy left to pick up the pieces when the credit-stimulus-speculation bubbles all pop.

When financial experts mention natural development, they’re referring to growth that develops naturally from the growth of population, advances in performance got from much better training and sensible investments and the fruits of development.

Organic development doesn’t need consistent stimulus, nor is it depending on speculation. It does not need to be juiced by central banks and government to function. In an economy that isn’t dependent on stimulus, the role of central banks is limited to being the loan provider of last hope in periodic financial crises, and federal government’s role is to serve the common good by moneying what fosters the typical good but isn’t lucrative enough for private companies to pursue, for instance, rural electrification and vital infrastructure.

Compare this Real Economy with the Artificial Economy we now have that is completely depending on reserve bank and government stimulus and rampant speculation. If either the stimulus or speculation disappeared, the economy would collapse. Without continuously increasing financial and fiscal stimulus, the property bubbles inflated by stimulus would collapse.

Every choice in this stimulus-speculation-dependent economy is keyed off of Federal Reserve stimulus or federal costs assurances. Think about the decision to buy or build a residence to live in or hold as an investment. This decision is now keyed to Federal Reserve control– scrape away the sugar-coating and this is what it is– of mortgage rates and the market for home mortgages (home mortgage backed securities) and federal government backstops and assurances.

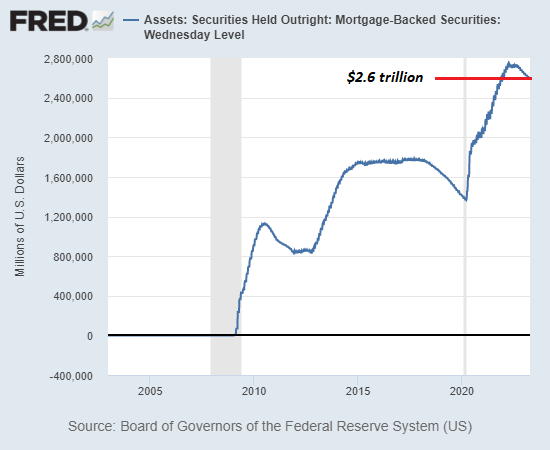

Glimpse at the very first chart below of the Fed’s “intervention” in the mortgage market: in some way the real estate/ home loan market made it through without the Fed owning any home mortgage backed securities prior to 2009, today the Fed should step in to the tune of trillions of dollars to keep the housing/ home mortgage market from imploding.

All this stimulus is offered as “help” however everything ends up “helping” the most affluent few at the expenditure of the bottom 90%. Look at the 2 charts below of the percentage of wealth held by the leading 1% and the portion of wealth held by the middle class, those families between 50% and 90% in regards to household earnings. Every new Fed/ federal stimulus pushes the wealth of the 1% greater and the wealth of the middle class lower.

To those pressing the stimulus, the skyrocketing wealth of the top 1% is “success” because that’s their circle of colleagues and buddies. If we’re doing excellent, everybody needs to be doing great. Such is the hubris and rejection olf our financial and political management.

You’ll see 3 charts all show parabolic increases: the Fed balance sheet, federal financial obligation and overall financial obligation. The primary type of stimulus is credit: broaden the accessibility of credit and (until just recently) make it cheaper to borrow by manipulating rate of interest lower.

All this “totally free money” sustained a dependency on speculation for “development,” a dependence that has burrowed the economy. As a direct result of all this stimulus/ credit, corporations have bought 10s of countless houses as leasings, pumping up another real estate bubble. Investors have purchased 10s of thousands of residences to capitalize the short-term leasing (AirBnB etc.) boom, successfully distorting the long-term rental markets and pushing leas higher.

Financial obligation and stimulus tracing parabolic ascents can not end well. Ultimately they collapse under their own weight.

Every addict has an excuse. Every junkie proclaims I can stop any time. Now that the United States economy is completely depending on trillions of dollars in stimulus and speculative gains reaped from the stimulus, there is no Real Economy delegated pick up the pieces when the credit-stimulus-speculation bubbles all pop.

Therefore we’re treated to the infantile charades of the Federal Reserve and our elected officials, both bleating how wunnerful everything is while in personal, with the mics securely muted, they’re desperate to push the inevitable implosion off simply a few more months. They have no option, and no chance to go back to an unmanipulated economy that isn’t dependent on ever larger injections of stimulus and parabolic boosts in debt.

The problem, buddies, is the United States economy has lacked veins for the coming injections of stimulus. The costs of dependence on artifices of stimulus and state of mind enhancement– whatever’s wunnerful!– are coming due, as they constantly do.

Regrettably, there’s no service aside from Cold Turkey, the collapse of all stimulus and all speculation. We will find out simply how unpleasant Cold Turkey can be, and babbling tirades of rejection will just make it worse.

New Podcast: Charles Hugh Smith on Getting Ready for a Genuine Economic downturn(38 minutes )(38 min) My brand-new book is now readily available at a 10 % discount( $8.95 ebook, $18 print): Self-Reliance in the 21st Century. Check out the very first chapter totally free(PDF)Read excerpts of all 3 chapters Podcast with Richard Bonugli : Self Dependence in the 21st Century(43

min)My current books: The Asian Heroine Who Seduced Me (Unique)

print$10.95, Kindle$6.95 Check out an

excerpt for free(PDF )When You Can’t Go On: Burnout , Reckoning and Renewal $18 print,$8.95 Kindle ebook; audiobook Check out the first area totally free( PDF) International Crisis, National Renewal: A(Revolutionary) Grand Strategy for the United States (Kindle$9.95, print $24, audiobook )Read Chapter One totally free(PDF). A Hacker’s Teleology: Sharing the Wealth of Our Shrinking World(Kindle$8.95, print$20, audiobook$17.46)Read the very first area for free (PDF ). Will You Be Richer or Poorer?: Profit

, Power, and AI in a Distressed World(Kindle$5, print$10, audiobook)Check out the first area free of charge(PDF). The Adventures of the Consulting Theorist: The Disappearance of Drake(Novel)$4.95 Kindle, $10.95 print); read the very first chapters for

complimentary(PDF)Money and Work Unchained$6.95 Kindle, $15 print)Check out the first area for free End up being a $1/month customer of my work via patreon.com. Register for my Substack free of charge KEEP IN MIND: Contributions/subscriptions are acknowledged in the order received. Your name and email stay confidential and will not be offered to any other specific, company or firm. Thank you, William H.($50), for your extremely generous contribution to this website– I am greatly honored by your unfaltering assistanceand readership. Thank you, Hunter($5/month), for your wondrously generous promise to this site– I am greatly honored by your assistance and readership. Thank you, Kitty B.($5/month), for your splendidly generous pledge to this site– I am greatly honored by your support and readership. Thank you, Richard H.( $50 ), for your magnificently generous

contribution to this site– I am greatly honored by your steadfast assistance and readership.