It is an acknowledged reality within the circle of Austrian Economic experts that the Central Banks need to continuously rely on and actively indulge in the propaganda of Voodoo Economics to hide the extreme imbalances that they have developed worldwide economy.

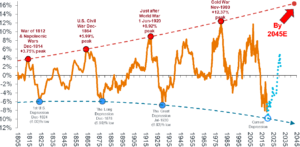

What lies in the decade ahead for much of the Western economies and the majority of parts of the world is a prolonged period of high inflation integrated with a financial anxiety. I ought to include that if one were to represent inflation correctly, even today, we are probably in stagflation (inflation + economic crisis) already in many parts of the world. However the deception of Central Banks in the method they underreport customer price inflation (CPI) will permit them to hide the truth for a couple of more months. If we draw a comparison between the stagflationary seventies (1970’s in which gold went from $35 to $850/oz, Oil from $3 to $40/barrel, etc.) and what lies ahead. Because, it’s a given that inflation is going to be substantially higher than what we had in the 1970s and the economic recessions much deeper.

Prior to I continue even more, it would be useful to clarify the term “Depression” used above. A lot of Financial experts confuse Anxiety with Deflation. These are 2 various economic phenomenon– the previous describes the condition of GDP development, and the latter describes a monetary phenomenon. Anxiety signifies an extended duration of rapid economic decreases and a steep fall in the living requirements of the majority of people. It relates primarily to negative GDP growth by a significant degree over at least a couple of years. On the other hand, deflation is a financial phenomenon that describes a condition of falling costs of consumer goods.

Depressions can be either deflationary or inflationary– in fact, more often than not, most depressions are inflationary. The 1930’s “The Great Depression” was deflationary, and the one we are living in the early phases of is going to be inflationary.

Does deflation lead to Anxieties?

Most Economic experts believe that deflation triggered the 1930’s Great Depression, and this is a misconception that the United States Fed has actually entirely propagated. As Murray Rothbard describes in his book “America’s Great Anxiety,” Deflation (or falling costs) made the depression a lot more tolerable than would otherwise have actually held true. The whole century before the development of the US Fed (from 1815 to 1914), when the US was on the classical gold standard, was deflationary. This was the period in which the United States economy transitioned from a primitive agrarian society to the world’s leading financial powerhouse with an approximated CAGR of more than 4% (with real growth being even greater due to falling rates) for a century.

If deflations result in an anxiety, the United States ought to have actually been a basket-case with a century of deflation leading up to 1914. Paradoxically, with more than a century of inflation since then, courtesy, the United States Fed, the United States Economy is undoubtedly a basket-case today, and the unraveling of the currency and the economy when it occurs in the years ahead will be quick and definitive.

Now that a basic however crucial distinction has been made, we can expand on the style of the Inflationary Depression ahead.

So how did we reach this precipice …?

Well, for the world to have reached such a precarious scenario as I have actually painted above, the issues have to be deep-rooted, basic, and long-standing. That is the case, and as Mises stated during 1951, the origins can predictably be traced to the Central Banks.

“There is nowadays a very guilty, even hazardous, semantic confusion that makes it incredibly hard for the non-expert to comprehend the real state of affairs. Inflation, as this term was constantly utilized all over and especially in this nation [the United States], indicates increasing the quantity of cash and bank notes in circulation and the quantity of bank deposits based on check. However individuals today use the term “inflation” to refer to the phenomenon that is an inevitable consequence of inflation: the tendency of all costs and wage rates to rise. The result of this awful confusion is that there is no term left to symbolize the cause of this rise in rates and wages. There is no longer any word offered to symbolize the phenomenon that has actually been, up to now, called inflation. It follows that no one appreciates inflation in the standard sense of the term. As you can not speak about something that has no name, you can not combat it. Those who pretend to eliminate inflation are, in reality, just fighting what is the inevitable repercussion of inflation, rising costs. Their ventures are destined failure because they do not assault the root of the evil.”

What Mises rued above is typically referred to as “Inflation is too much cash going after too couple of items.” Or, as Milton Friedman stated, “Inflation is and everywhere a Monetary Phenomenon.” What Mises spoke of in 1951 today is common. It would be almost difficult to identify a single financial analyst (aside from the handful of Austrian Economic experts) who would identify the cause from the impacts when speaking about inflation. To add insult to injury, many mainstream economic analysts believe that customer rate inflation is brought on by growth and that “some” inflation is indeed good/desirable/ required for economic progress.

The above US Fed propaganda of the witchcraft Keynesian economics has actually indeed been extremely effective– so much so that after a century, even they appear to think in it themselves. The last United States Fed Chairman who understood the distinction between propaganda and the reality was Alan Greenspan. His essay “Gold and Economic Liberty” remains one of the best expositions composed to date on this subject. The subsequent ones have actually been purebred Keynesians, who practically sign up for the above ridiculous concept as gospel fact.

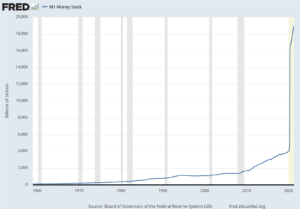

So under the garb of promoting economic development, we have actually just enabled the reserve banks around the world to print cash with impunity. This has long held true considering that 1971 when the last vestiges to Gold and Currency were gotten rid of. After Richard Nixon closed the Gold Window “briefly” in 1971, the Central Banks have had little factor to restraint themselves. However they have indeed gone berserk after 2008, and even more so in the in 2015 or 2. Each transgression makes the erstwhile felony appear like a misdemeanor.

Where has all the inflation, because 2008– Gone? Moving forward, we will utilize the expression “financial inflation” to denote the cause and

“consumer cost inflation”to signify the impacts. Throughout the 1970s, the link between rising financial inflation and increasing consumer rates was incredibly well understood. The cash supply growth figures that the United States Fed used to release weekly was among the most keenly enjoyed numbers. Any irregular boost in the Fed Balance Sheet would welcome a strong rebuke from the Bond Vigilantes who sent the stocks and the bonds lower.

It is impressive to see how standard financing and economics have been reshaped diabolically in just a few years. Extremely few analysts and even financial experts comprehend the connection these days. A lot more ironical is the belief that an unfavorable GDP growth/unemployment report is seen as great for stocks and bonds as the Fed would then expand its balance sheet by means of QE to suppress yields. This thinking is nearly as perverse as the “Tulipmania.” Though it has actually survived a lot longer than the typical asset bubble, the days of such Voodoo Economics are numbered, and we are now in the early stages of the unraveling of the epic “Fed Bubble.”

Returning to the concern positioned above– Where has all this “financial inflation” gone, particularly because the pattern of enormous monetary inflation given that 2008?

As readers can see, there has been a significant divergence in between monetary inflation and consumer cost inflation since the Great Economic downturn of 2008. How do we describe this

? The CPI number reported is a procedure of self-appraisal by Central Banks, so they have a strong intention to underreport the real numbers. There is no conspiracy theory in this, but the way CPI calculations have actually progressed since the 1970s using substitution, hedonic modifications, owner’s comparable lease, etc., guarantees a built-in bias towards the under-reporting of numbers.

A number of economists calculate CPI using the exact same method as was done throughout the 1970s (John William of Shadow Statistics, for example). Those numbers reveal inflation in high single-digits/ low double-digits, which would follow the financial inflation that we have actually observed.

However there is an even more important reason– Austrian Economists describe as the Cantillon Impact. This essentially suggests that while the cash Supply growth will trigger the cost of various assets to increase in different percentages. Indeed it is even possible throughout times of even relatively high cash supply growth for one category of assets to go up while the others go down, not just in relative terms however in small terms also.

This Cantillon Impact indicates that all monetary inflation has entered into monetary properties– Stocks, Bonds, Real Estate, Bitcoin, Nasdaq 2.0, etc.– that do not show up in the CPI numbers. Any logical financier who understands the essentials can observe a sea of active bubbles in these property classes that synthetically low-interest rates have propped.

The 10-year treasury that underlines the evaluations of the above classes has actually been reduced by the United States Fed that there is no basis for rationally valuing these properties any longer. Courtesy, the US Fed, small interest rates are at a 5000-year low, and it is the unavoidable boost in rates that will trigger these bubbles to unwind.

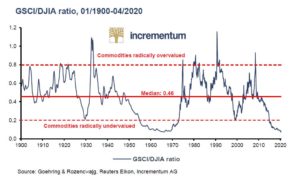

The only asset class that remains underestimated, nearly by definition, is products. Commodities in a relative sense, have actually never been cheaper in 100 years than what it is today. So essentially all the cash printed has wound up driving the prices of all other property classes to valuation hitherto unheard of.

What Provides?

So what has accompanied the high M2 growth because 2008 is the price of stocks, bonds, and real estate? And what has decreased in relative terms are the commodities. This mainly describes why the CPI has actually stayed silenced over the last years. So why can’t this situation continue for a few more years or another years …?

In this impressive fight between US Fed and Noise Cash (gold and silver), we crossed the rubicon when the CRB indexed bottomed out in Apr 2020. Gold has actually always been a leading sign and has actually been on an uptrend because early 2016. Given that the Index bottomed more than a year back, it is up more than 50%, albeit from historically really low levels.

Source: Stifel Report June 2020. Note: Shown as 10yr rolling compound development rate with polynomial pattern at tops and bottoms. Blue dotted line highlights a forecast evaluation. Source: Warren & Pearson Commodity Index (1795-1912), WPI Commodities (1913-1925), equal-weighted (1/3rd ea.) PPI Energy, PPI Farm Products and PPI Metals (Ferrous and Non-Ferrous) ex-precious metals (1926-1956), Refinitiv Equal Weight (CCI) Index (1956-1994), and Refinitiv Core Product CRB Index (1994 to present).

All products– lumber, steel, zinc, soybeans, corn, etc.-are up substantially over the last year. While this is credited to the covid caused supply reductions, the cause for all inflation is the very same whenever– an excess supply of money. This boost in product rates is causing the CPI in the US to levels of 5%+. An intriguing observation would be that Richard Nixon, who closed the gold window, introduced wage and cost controls when CPI crossed 4%, never troubling to think about inflation’s possible “temporal nature.”

Forget the future monetary inflation, which I am sure will make the financial growths considering that 2019 look like another misdemeanor, but we have actually currently created sufficient financial inflation that ensures a product uptrend for the next several years. This will make sure that the dream of the United States Fed that these CPI increases are temporal remains simply that– a dream. I would not in the least be shocked if CPI doubles from the current 5%+ to reach a double-digit number within a 12-18 month timeline.

Does the Fed think that CPI is Transitory?

I don’t in the least believe that to be the case.

What should the proper actions of the United States Fed be if CPI is 5%+ and showing an increasing pattern on an m-o-m basis.? In the normal scenario, the interest rate must be such that genuine interest rates are positive, implying a rate of interest of a minimum of 5%. Where is the interest rate today?

ABSOLUTELY NO. Or really close to that. After more than eight years at near zero, when the US Fed under Jerome Powell attempted to reverse course and increased it to 2.5% over a three-year period (between 2016 and 2019), the scrap bond pretty much froze and threatened to unwind the entire United States monetary system. Predictably, in very brief order, Powell took it back to its initial levels.

If the United States Fed could not raise rates when the National debt was less than $20 Trillion, what possibilities are there for a comparable action when the debt is anticipated to cross $30T in the next few months? The threat of a market collapse that happened at a 2.5% rate in 2019 will most likely happen even at a 1 to 1.25% rate today. The utilize in the system is a lot higher than the likelihood of having favorable real interest rates in the US for the foreseeable future is ZERO. There can be no two ways about it.

So given that the United States Fed can not have rate of interest at a level that will cut the monetary inflation, what can they do? The only option for them is to pretend that the existing Customer Price Inflation (which is the outcome of years of financial inflation) is temporal. They require not start a strategy ensured to collapse the United States stocks, bond, and real estate market.

Completion Video game

As said, we are at the early stages of an Inflationary Depression in the US and something that will run for a decade if not longer. Provided this, the double required of the US FED, i.e., maximum employment and rate stability, can not be pursued any longer. They will need to select in between controlling customer cost inflation with markedly higher interest rates and continuing with the impression of a steady economy for a couple of more months with this artificially low-interest rate regime.

Years of synthetically low-interest rates have led to significant malinvestments in the US with extreme debt-fueled consumption and very little savings-led production. The only option is to put interest rates at a high sufficient level to significantly shrink the growth in the money supply and reduce the national financial obligation. That, obviously, will instantly plunge the United States economy into a massive economic crisis.

Readers should remember that Paul Volcker did not put the United States interest rates at 20%+ in the early 1980s for amusement or because he desired the US to suffer an economic crisis. That was the only option in front of him at the phase, i.e., saving the United States Dollar or lengthening the malinvestments. The choice is, a lot more plain today. If the United States Fed attempts to prolong the bubble economy by preserving these deeply negative genuine rate of interest, it will damage the United States Dollar.

That, unfortunately, is the most likely course of action for the US Fed also. Predicting the specific timing of the United States Dollar crisis is laden with danger. However given the imbalances, the size of the bubbles in the United States Economy, and the reasonably early phases of the Products booming market, I believe we will witness the collapse prior to Biden completes his term. That regrettably is the most likely course of action for the United States Fed also. Anticipating the specific timing of the US Dollar crisis is laden with risk. However offered the imbalances, the size of the bubbles in the US Economy and the rather early stages of the Commodities bull market, I believe we will witness the collapse prior to Biden completes his term.

Editor’s Note: It’s clear the Fed’s money printing is about to enter into overdrive. The Fed has currently pumped massive distortions into the economy and inflated an “whatever bubble.” The next round of cash printing is most likely to bring the scenario to a snapping point.

We’re on the cusp of a global recession that might eclipse anything we’ve seen prior to. That’s precisely why bestselling author and legendary speculator Doug Casey just released this urgent video. Click on this link to see it now.