When the caution light is flashing red, it’s sensible to have a capital preservation technique in location.

Not everybody has an IRA or 401K bought the stock exchange, for those who do, the red warning light is flashing red: markets have actually reached historical extremes on many fronts.

Much like in 2000, supporters claim “this time it’s various.” At that time, the claim was that given that the Internet would be growing for years, dot-com stocks could go to the moon and beyond.

The claim the Internet would continue growing was sound, but the forecast that this growth would drive stock appraisals into a nonstop bubble was unsound.

As soon as again we hear reasonable-sounding claims being used to support forecasts of a relentless increase in stock appraisals.

What hasn’t altered is people are still running Wetware 1.0 which has default settings for extremes of emotion, particularly manic euphoria, keeping up the herd (a.k.a. FOMO, fear of missing out) and panic/ worry.

In spite of all the guarantees to the contrary, all bubbles pop due to the fact that they are based in human feelings. We try to rationalize them by conjuring up the real world, however the reality is speculative manias are manifestations of human emotions and the feedback of running in a herd of social animals.

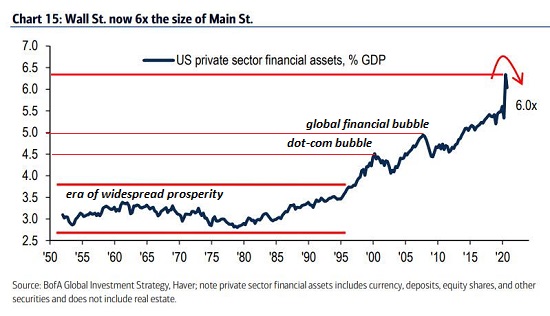

Here’s a chart of monetary properties as a portion of Gdp (GDP). (below) Note that in the “Remarkable Thirty” years of the postwar era of broad-based success, monetary properties were around 3 times GDP.

This ratio increased with each of the three bubbles since the mid-1990s: the dot-com bubble in 1999-2000 (Fed Bubble # 1), the subprime bubble in 2007-08 (Fed Bubble # 2) and now the Everything Bubble of 2020-21 (Fed Bubble # 3). Monetary assets are now 6 times the size of the “genuine economy” (GDP), a severe beyond all previous extremes.

This shows the supremacy of monetary possessions based on extreme expansions of debt, utilize and speculation.

The red warning light of extremes in sentiment, evaluation, and so on can flash for rather some time, however as I have actually kept in mind for many years, speculative bubbles often show symmetry: those that increase higher tend to collapse in a mirror-image of the manic increase. This proportion isn’t ideal, of course, simply as correlations are hardly ever if ever best, however as a generality, bubbles tend to show proportion as manic greed slips into doubt and after that waterfalls into panic. (see chart listed below)

Severe bullishness is noteworthy. (see chart below of S&P 500 stocks above their 200-day moving average– a standard definition of a stock in a bullish pattern.) Not just is the number of S&P 500 stocks that aren’t in a bullish uptrend basically signal noise, this severe reading has actually been pegged to the upper boundary for weeks, far longer than the extremes reached in previous manias.

As my old quant employer Stew Pillette would observe, when all fortunately is out and has actually already been priced into the marketplace, the next little bit of news is most likely to be bad and not priced in.

There are 7 aspects to bear in mind that may intensify turnarounds and threats:

One factor to keep in mind is the supremacy of ETFs (exchange-traded funds) and index funds. As cash puts into these passive funds, the funds purchase whatever stocks are in the ETF or index. Good, bad and indifferent stocks in each ETF or index are bought without any assessment of their relative worth.

When owners offer, the process is reversed: every stock in the ETF or index is instantly sold to fund the redemption. This results in “the child being thrown out with the bathwater” as the very best performing companies get sold with the dregs in the ETF or index.

Another factor to keep in mind is the dependence of bubbles on obtained cash (margin financial obligation) and take advantage of: 2X and 3X leveraged ETFs and a variety of financialization techniques to increase leverage and hence gains. When possessions that have been leveraged reverse even modestly, the losses are rapidly substantial, and the “service” is to liquidate every leveraged asset prior to the position is eliminated. Selling begets offering, and this is the self-reinforcing feedback of crashes.

A third element to bear in mind is the decrease of brief interest to all-time lows. Put another way, the number of speculators who have a reward to purchase shares in a decline is near lowest levels, so the only buyers in a genuine decline will be “buy the dip” gamers who will soon be eliminated if the decrease continues.

A 4th factor to bear in mind is the constricting of the speculative universe into a couple of possessions. This produces an extreme dependence on the couple of rocketships to keep skyrocketing lest the entire ETF/ index fund world collapse.

A fifth factor to keep in mind is the capacity for the Covid virus to spread worldwide beyond existing expectations. Such a growth might set off a worldwide downturn/ economic downturn.

A 6th indicate bear in mind is that all financial and monetary stimulus struggles with diminishing returns. (see chart listed below) The chart of cash speed recommends the returns have actually fallen off a cliff. (see chart below)

A seventh element is the supremacy of algorithm-driven trading (algos, trading bots, and so on, which appears to be mostly set to be momentum/ trend-following. If these programs are withdrawn to avoid high volatility, the liquidity the marketplace depends on to keep stability may dry up, increasing the odds of the marketplace going bidless, i.e. purchasers disappear and rates crash.

When the caution light is flashing red, it’s sensible to have a capital preservation strategy in place.

< img align ="center"src=" https://www.oftwominds.com/photos2021/dot-com-bubble2.png "/ > If you discovered value in this content, please join me in looking for solutions by ending up being a $1/month client of my work by means of patreon.com.

My brand-new book is offered! A Hacker’s Teleology: Sharing the Wealth of Our Diminishing Planet 20% and 15% discounts (Kindle $7, print $17, audiobook now available $17.46)

Read excerpts of the book free of charge (PDF).

The Story Behind the Book and the Intro.

Current Podcasts:

AxisOfEasy Beauty salon 42: Is System Modification Likely, Possible or Unavoidable? (58 minutes)

Charles Hugh Smith on the Terminally Ill Economy (49 minutes)

Keiser Report|Bilking Granny is the Business Design

In the 2nd half, Max interviews Charles Hugh Smith of OfTwoMinds.com about the ‘fatal synergies’ and the ‘sealed pressure cooker’ resulting when the system declines to offer a service to those denied a voice or access to resources. They likewise talk about the oversupply of elites and the mayhem this eventually gives society.

My current books:

A Hacker’s Teleology: Sharing the Wealth of Our Diminishing World (Kindle $8.95, print $20, audiobook $17.46) Read the first area totally free (PDF).

Will You Be Richer or Poorer?: Revenue, Power, and AI in a Shocked World

(Kindle $5, print $10, audiobook) Check out the first section free of charge (PDF).

Pathfinding our Fate: Avoiding the Last Fall of Our Democratic Republic ($5 (Kindle), $10 (print), ( audiobook): Read the very first section totally free (PDF).

The Adventures of the Consulting Thinker: The Disappearance of Drake $1.29 (Kindle), $8.95 (print); checked out the first chapters for free (PDF)

Cash and Work Unchained $6.95 (Kindle), $15 (print) Check out the first section free of charge (PDF).

End up being a $1/month customer of my work by means of patreon.com.

KEEP IN MIND: Contributions/subscriptions are acknowledged in the order received. Your name and email remain personal and will not be given to any other specific, business or company.

|

Thank you, Cynthia F. ($50), for your marvelously generous contribution to this site– I am significantly honored by your support and readership. |

Thank you |

, John S. ($50), for your magnificently generous contribution to this website– I am considerably honored by your steadfast assistance and readership. |