It’s a peculiarity of the human mind that it’s incredibly simple to be swept up in bubble mania and remarkably tough to be swept up in the same way by the bubble’s inevitable collapse.

Enable me to sum up the dominant zeitgeist in America at this point of history: Get yourself a huge gooey hunk of happiness by turning a few thousand dollars into millions– anyone can do it as long as they visualize abundance and sign up with the crowd minting millions.

Below the blowing and euphoric confidence in our God-given right to mint millions out of small potatoes, a secret plea prowls unspoken: please don’t pop our valuable bubble! The huge gooey hunk of joy available to all depends on one special kind of magic spell: If we don’t call the bubble a bubble, it will not pop.

Therefore Wall Street shills gush unlimited “research” (heh) announcing that the forward price-earnings ratio of 21.1 will just a little go beyond previous standards, and so on– in summary: If we don’t call the bubble a bubble, it will not pop.

What distinguishes this bubble from the 1720 South Seas Bubble, the 2000 dot-com bubble or the 2007-08 housing bubble is: this bubble consists of every possession class and has actually drawn the whole population and economy into its magic maw.

The bubble has swept up housing, stocks, junk bonds, commodities, cryptocurrencies, NFTs, and many collectibles– the bulk of America’s household possessions are now strongly lodged in the maw of the Whatever Bubble.

Here is a tasting of recent headings in America:

I turned $10,000 into $6 million in 6 months.

My cat turned $6,000 in my RobinHood account into $6 million by strolling on my keyboard.

I turned $100 my aunt offered me for the birthday into $6 million in one trade, buying escape of the cash calls on a meme stock.

I turned $23 into $6 million so quickly I’m going to sleep my way to $60 million.

OK, so these are slight exaggerations, however the zeitgeist is extremely real.

Another distinguishing element is the Whatever Bubble has no boundaries. Flipping houses takes work as it is connected to the real-world home being turned. But NFTs (non-fungible tokens) have no limits: an NFT can represent/instantiate a rock, image, broke glass, etc., and there are no limits on how many NFTs can be originated.

In the Whatever Bubble, it is not unexpected that a substantial portion of Americans have purchased NFTs and numerous view NFTs as genuine investments comparable to cryptos, stocks, bonds and housing.

The only problem with the if we don’t call the bubble a bubble, it will not pop magic mantra is that it has an expiration date. Human greed is limitless, the variety of currency systems that can be provided by reserve banks is endless, the variety of NFTs that can be originated is unrestricted, and wonderful thinking has no limits, but enough of the assets being inflated in the Whatever Bubble have faint ties back to the real life such that the distortions in the fictional world of boundless wealth end up misshaping the real life, which is much less forgiving than the imaginary one.

All speculative manias pop, even if nobody calls the mania a bubble. The very first decreases are bought, as purchase the dip has never ever stopped working, however given that the smart cash offered long earlier, there isn’t adequate dumb money to keep the bubble inflating. Cats strolling on keyboards start generating massive losses, and all the punters who minted cash are torn between HODL (hang on for dear life, i.e. never ever sell) or making outsized gambles on long shots that were ensured winners a couple of months back.

This continues up until the $6 million roundtrips back to $6,000, and after that the tax expense shows up: somehow minting millions accrued taxes that aren’t completely balanced out by the losses.

Or the margin call surpasses the liquidated value of the account, and the can’t-lose punter now owes the brokerage significant cash.

However never ever mind the banquet of consequences currently being laid out: perhaps if all of us yell please do not pop our valuable bubble! the bubble will never ever pop and our $6 million will end up being $60 million and after that $600 million.

In the manic grip of blissful confidence, it seems difficult the bubble will ever stop inflating. Every dip generates a rally, and the method of rotating out of a weakening sector into a hot-hot-hot sector will clearly work permanently.

It’s a peculiarity of the human psyche that it’s extremely easy to be swept up in bubble mania and remarkably difficult to be swept up in the very same way by the bubble’s unavoidable collapse. It’s exceptionally tough to offer, ignore the bubble mania and not recall. That’s why so few people succeed in doing so. Those couple of who do get to keep whatever huge gooey hunk of joy they detached during the mania and everyone who stays in the casino while it burns down watches their huge gooey hunk of joy melt away.

The banquet of effects is being served, and everybody will attend. What you’re served depends on when you offered.

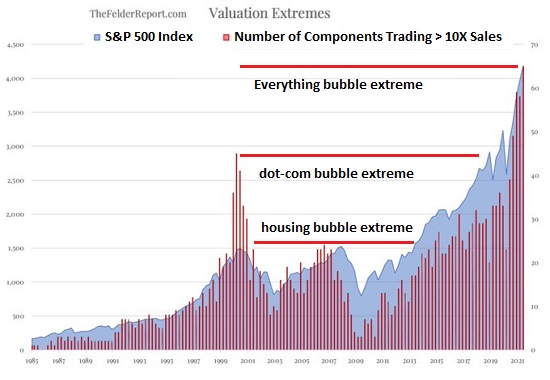

S&P 500 stocks over 10 times yearly sales: please do not pop our precious bubble!

S&P 500 Everything Bubble compared to bubbles # 1 and # 2: please do not pop our precious bubble!

Billionaire wealth increasing in the Whatever Bubble: please do not pop our valuable bubble!

If you found worth in this material, please join me in looking for services by ending up being a $1/month client of my work via patreon.com.

My new book is offered! A Hacker’s Teleology: Sharing the Wealth of Our Diminishing Planet 20% and 15% discounts (Kindle $7, print $17, audiobook now offered $17.46)

Read excerpts of the book totally free (PDF).

The Story Behind the Book and the Intro.

Recent Videos/Podcasts:

Charles Hugh Smith on Secular Inflation (Host Richard Bonugli, 31 minutes)

My recent books:

A Hacker’s Teleology: Sharing the Wealth of Our Shrinking Planet (Kindle $8.95, print $20, audiobook $17.46) Read the very first area totally free (PDF).

Will You Be Richer or Poorer?: Revenue, Power, and AI in a Shocked World

(Kindle $5, print $10, audiobook) Check out the very first section free of charge (PDF).

Pathfinding our Destiny: Preventing the Final Fall of Our Democratic Republic ($5 (Kindle), $10 (print), ( audiobook): Check out the very first section for free (PDF).

The Experiences of the Consulting Thinker: The Disappearance of Drake $1.29 (Kindle), $8.95 (print); checked out the very first chapters for free (PDF)

Money and Work Unchained $6.95 (Kindle), $15 (print) Check out the very first section free of charge (PDF).

Become a $1/month customer of my work via patreon.com.

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and e-mail stay confidential and will not be given to any other private, company or firm.

|

Thank you, Les M. ($250), for your beyond-outrageously generous contribution to this website– I am significantly honored by your steadfast assistance and readership. |

Thank you |

, John M. ($54), for your superbly generous contribution to this site– I am considerably honored by your assistance and readership. |

|

Thank you, Luke H. ($5/month), for your marvelously generous promise to this website– I am significantly honored by your assistance and readership. |

Thank you |

, Warren J. ($10/month), for your outrageously generous promise to this website– I am considerably honored by your support and readership. |