Maybe maximizing corporate earnings isn’t all that matters. Maybe nationwide security and strength matter, too, and if they do, then reshoring critical supply chains must be a greater top priority than Business America’s (primarily tax-free) earnings.

As America’s trade deficit takes off higher and the expenses of offshoring supply chains install, the apologists for globalization are out in full force, attempting to scream down truth with their usual specious claims about how incredibly wunnerful globalization has actually been for America.

Permit me to tote up the real-world expense savings:

Cost of inexpensive uncomfortable jeans dropped $10.

Cost of low-grade TV that will only last a couple of years dropped $50.

Cost of healthcare, annual increase: $3,000 per home

Expense of rent, annual increase: $1,200 per family

Cost of childcare, annual boost: $1,300 per home

Expense of college tuition and space and board, yearly boost: $1,500 per home

So while domestic costs rose $6,000 each year due to predatory cartels, over-regulation, taxes, and so on, we conserved $60 by offshoring supply chains. Excuse me for being underwhelmed by the wunnerfulness of offshoring jobs and supply chains.

Yes, the advantages of open market, blah-blah-blah, I get it; however there is no such thing as open market, there are just variations of managed trade, the large majority of which are advantageous to corporations and elites on both sides of the trade.

Trade is constantly about taking full advantage of profits. That’s the only factor to trouble with trade, though there are geopolitical factors to consider also. The U.S. opened its large markets to Western Europe and Japan and the Asian Tigers in the Cold War to reinforce their economies, as a means of suppressing the appeal of Communism in their domestic politics.

This mercantilist technique worked well, ushering in fast development in West Germany, Japan and other allied countries, however the issue is those economies never transitioned out of being mercantilist, export-dependent economies. The U.S. has actually remained the discarding ground for the world’s surplus production considering that the early 1950s.

While it’s all too easy to blame China for soaring trade deficits, no one forced Corporate America to transfer supply chains to China; it was all done to maximize profits, since that’s all that matters, right?

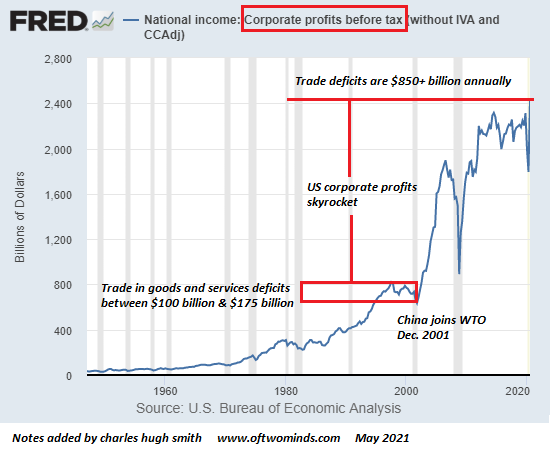

If we examine the chart of U.S. business earnings, we discover they were around $700 billion every year in the high-growth 1990s when America’s trade deficit in items and services changed between $100 billion and $175 billion yearly. Once China went into the World Trade Company (WTO) in 2001, corporate revenues– and trade deficits– skyrocketed.

This is not coincidence. Corporate America gained trillions in earnings by offshoring production and supply chains. 3 points require to made here: one is that trade in items is grossly misshaped by out-of-date rules for calculating imports and exports. Analysts estimate that as little as $10 of the value of every iPhone or iPad really ends up in the Chinese economy, in the type of earnings paid directly to Foxconn or other contractors. However the iPhone– assembled in China with parts sourced internationally– is counted as a $250 import from China when it arrives at the port of Long Beach, California.

The other is that China paid a steep cost for its quick financial growth as the sweatshop for global corporations. The ecological damage of rapid industrialization has actually been tremendous, lots of workers were cheated by contractors who promised impossibly low costs to Western corporate buyers, and profit margins were razor thin for lots of providers.

The American workforce paid a high rate, as did U.S. nationwide security, as important intellectual property was lavished on China in exchange for those necessary quarterly boosts in business revenues.

Corporate America made out like outlaws. Everyone else– not so much. Thanks to expensive legalized robbery footwork, most American corporation gaining shocking make money from overseas production pay little or no taxes that benefit the American citizenry.

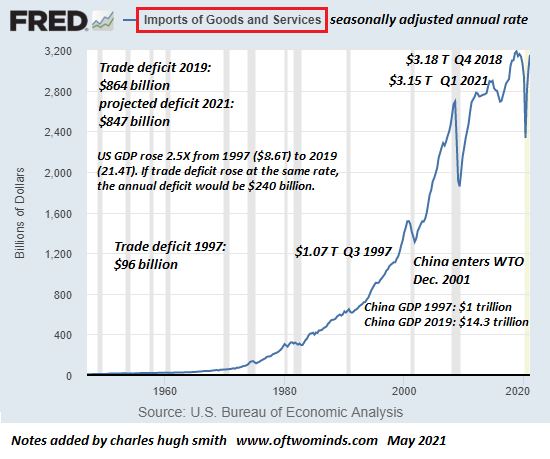

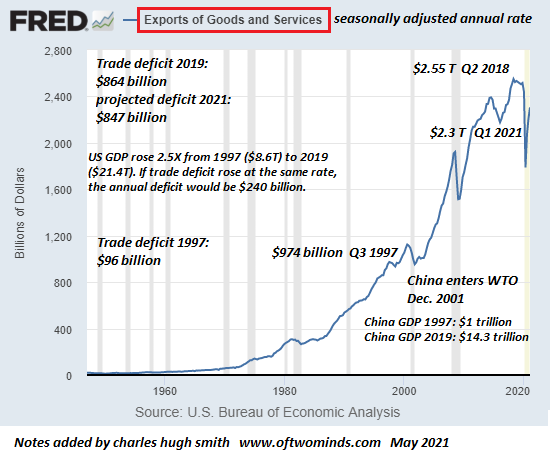

Let’s take a look at the charts of U.S. imports and exports. If trade deficits had actually risen together with U.S. gdp (GDP) in the 24 years considering that 1997, it would have increased 2.5-fold, to an annual rate of about $240 billion.

The real trade deficit is $600 billion greater: $850 billion every year. $600 billion here, $600 billion there, quite quickly you’re talking genuine cash.

Notification that thanks to trillions in stimulus, imports have actually soared back up while exports have lagged. That’s what occurs when you offshore your critical supply chains.

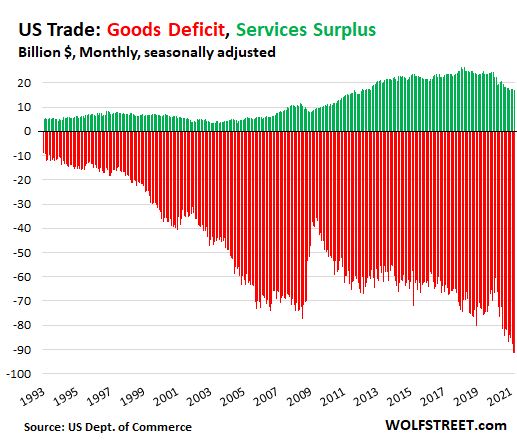

My informative blogger colleague Wolf Richter just recently published an illuminating chart of service surpluses and products deficits: it’s obvious that much of the stimmy invested at WalMart purchased things from China.

He added these thought-provoking remarks in his post Just Keeps Worsening: Solutions Trade Surplus, the American Dream Not-Come-True, Falls to 9-Year Low, Overall Trade Deficit Explodes to Worst Ever:

“Note that throughout the Financial Crisis, the general trade deficit improved substantially. Consumers cut back purchasing imported resilient products, while the trade surplus of services decreased only briefly.

The opposite happened during the Pandemic where stimulus fired up US consumer demand, enhanced foreign manufacturing, however did nothing for US exports.

Every crisis in the United States over the previous two decades has triggered Business America to cut expenses even more by pressing offshoring to the next level. And after each crisis subsides, the trade deficits and US dependence on foreign manufacturing plants (no matter who owns them) are even worse than before.

This dependence has actually become painfully apparent in a few of the lacks, including the semiconductor scarcity now rippling through the US economy. The US, which for decades had actually led the world in semiconductor style and production, now makes only 12% of global semiconductors.”

Possibly optimizing business revenues isn’t all that matters. Possibly nationwide security and resilience matter, too, and if they do, then reshoring vital supply chains must be a greater top priority than Business America’s (primarily tax-free) profits.

Of related interest:

Forget “Free Trade”– It’s Everything About Capital Streams (3/9/18)

If you discovered worth in this content, please join me in looking for services by becoming a $1/month patron of my work through patreon.com.

My new book is offered! A Hacker’s Teleology: Sharing the Wealth of Our Diminishing Planet 20% and 15% discounts (Kindle $7, print $17, audiobook now available $17.46)

Read excerpts of the book free of charge (PDF).

The Story Behind the Book and the Intro.

Recent Podcasts:

Beauty parlor # 43: History shows once again and again how nature explains the folly of guys …

Covid Has Actually Activated The Next Great Financial Crisis (34:46)

My recent books:

A Hacker’s Teleology: Sharing the Wealth of Our Diminishing Planet (Kindle $8.95, print $20, audiobook $17.46) Check out the very first section totally free (PDF).

Will You Be Richer or Poorer?: Revenue, Power, and AI in a Traumatized World

(Kindle $5, print $10, audiobook) Read the very first section free of charge (PDF).

Pathfinding our Destiny: Avoiding the Last Fall of Our Democratic Republic ($5 (Kindle), $10 (print), ( audiobook): Check out the first area for free (PDF).

The Experiences of the Consulting Theorist: The Disappearance of Drake $1.29 (Kindle), $8.95 (print); checked out the first chapters for free (PDF)

Money and Work Unchained $6.95 (Kindle), $15 (print) Check out the first section totally free (PDF).

End up being a $1/month patron of my work through patreon.com.

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email stay private and will not be offered to any other individual, company or agency.

|

Thank you, Costs G. ($5/month), for your fantastically generous pledge to this site– I am greatly honored by your assistance and readership. |

Thank you |

, Greg H. ($5/month), for your outrageously generous pledge to this website– I am considerably honored by your steadfast assistance and readership. |