Blowback has its own characteristics, as we’ll learn in the decade ahead.

Among the most long lasting expectations in the monetary sphere is that inflation will drop sharply in an economic crisis and the Federal Reserve will decrease interest rates back to near-zero. There is a great factor to doubt this: rising salaries. Yes, we all find out about the countless human workers who will shortly be replaced by AI– terrific for corporate revenues!– however few pundits trouble looking at long cycles in rate of interest and inflation, and even fewer pay any attention to the ridiculously extreme asymmetry of labor and capital.

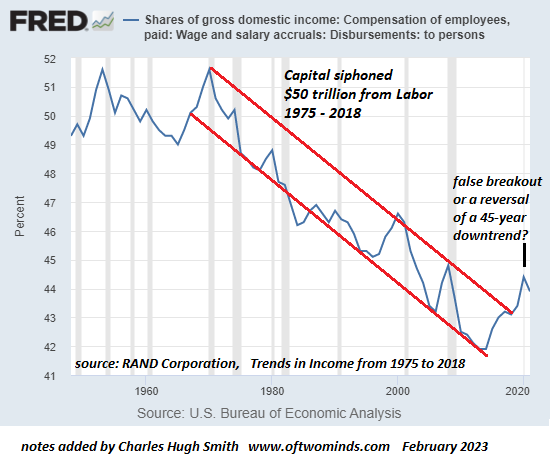

As I have actually frequently noted here, labor’s share of the economy has actually fallen for 45 years. Just recently did it reverse somewhat. It’s not yet clear if this was a quick false-breakout ot a modification in trend, however there are great factors to expect a nonreligious, cyclical reversal that lasts years or perhaps a decade.

Simply put, a years in which labor/ wages get at the expenditure of capital.

There are 2 fundamental narratives that are offered as descriptions for how capital siphoned $50 trillion from labor over the last 45 years. One is that the macro-forces of globalization and financialization inherently favor capital and reduce labor’s utilize as production and jobs were offshored and US workers entered a race-to-the-bottom competitors with developing countries’ affordable workforces– a competitors that kept US salaries stagnant even as US business earnings and monetary properties skyrocketed.

The other story starts with the observation that the erosion of earnings and the glorification of corporate power was the direct outcome of specific policies being embraced. The supremacy of corporate interests and the stripmining of labor were anything but inevitable: it was engineered by policies that enhanced the leading 0.01% (the Financial Aristocracy), and the leading 10% who own 90% of America’s productive capital.

This wholesale transfer of wealth and earnings from workers to Capital was recorded by a RAND Corporation report, Trends in Earnings From 1975 to 2018. Time magazine summed up the findings: The Leading 1% of Americans Have Taken $50 Trillion From the Bottom 90%– And That’s Made the U.S. Less Secure.

(We’re informed the stagnating salaries of the previous 45 years) were the regrettable however required price of keeping American services competitive in a significantly cutthroat international market. However in truth, the $50 trillion transfer of wealth the RAND report documents has actually occurred entirely within the American economy, not between it and its trading partners. No, this upward redistribution of earnings, wealth, and power wasn’t unavoidable; it was a political choice– a direct outcome of the trickle-down policies we selected to carry out given that 1981.

The net outcome of this four-decade siphoning of wealth/income from employees was recorded by a Foreign Affairs article: Monopoly Versus Democracy:

Ten percent of Americans now control 97 percent of all capital income in the nation. Almost half of the new earnings produced given that the international monetary crisis of 2008 has gone to the wealthiest one percent of U.S. residents. The richest 3 Americans collectively have more wealth than the poorest 160 million Americans.

To put it simply, the bottom 90% have very little stake in the status quo: they get essentially absolutely no earnings from America’s stupendous $140 trillion stockpile of private wealth and have essentially zero political impact, as documented in Checking Theories of American Politics: Elites, Interest Groups, and Typical Citizens.

We can see these truths in the information/ charts. As the charts listed below (thanks to the Federal Reserve FRED database) show, wages’ share peaked in the early 1970s and trended down for 45 years. Corporate revenues escalated 15.7-fold because 1982 while inflation increased “just” 3-fold.

This decrease in earnings is mirrored by a corresponding decline in the wealth of the bottom 90%. It’s not simply wages that stagnated– so did the share of the country’s wealth held by the middle class/ bottom 90%.

The middle class’s share of private-sector wealth (overall net worth) has actually dropped from 37% in the early 1990s to 28%, a decline of $12 trillion compared to what would have held true had the middle class continued to hold 37% of net worth.

$50 trillion here, $12 trillion there, quite quickly you’re talking genuine cash that’s been moved from the wage-earning peasantry to America’s Financial Aristocracy.

We see this large asymmetry in who gathers the main engine of wealth for the top few: capital gains. Those who already own the majority of the wealth have actually stolen the stupendous gains of the previous three years. Middle class households pocket $4,000 or $5,000 in yearly capital gains while those who own most of the wealth pocket on average a cool $1 million– 200 times the middle class gain in unearned income.

So why will salaries increase, no matter deflation and AI? Catch-up and blowback. Even if we accept the “gee, we were defenseless to stop wage stagnancy” story (which is false, as detailed above), financialization and globalization are reversing and so labor can finally play catch-up to capital’s uneven gains.

If catch-up is reduced by corporate political power, then blowback kicks into gear. The workforce has had enough of corporate-state pillaging, and while corporations are gleefully planning the removal of their human workforce through AI and automation, that dream isn’t going to play out as expected, for automation has limits which I discuss in my book Will You Be Richer or Poorer?.

Nobody thinks that there could be political limits on corporate power, but valuable couple of asymmetries that reward the couple of at the expense of the numerous last permanently. Blowback has an exceptional ability to careen from no one notifications or cares to full-blown revolt in reasonably short order. The higher the asymmetry, plunder and hubris of the Aristocracy, the higher the ultimate swing of the pendulum to the opposite extreme. Blowback has its own characteristics, as we’ll learn in the decade ahead.

Incomes– and the inflation they produce– are going up for excellent whether anybody thinks this is possible or not. And inflation pulls interest rates greater, whether anybody thinks this is possible or not. It’s not simply the Federal Reserve that matters; asymmetries, exploitation and plunder matter, too.

New Podcast: Its a Waterfall -Danger, Collateral & Productivity (48 minutes)

My new book is now readily available at a 10 % discount ($8.95 ebook,$

18 print): Self-Reliance in the 21st Century. Read the very first chapter for

free (PDF)Check out excerpts of all 3 chapters

Podcast with Richard Bonugli: Self Reliance in the 21st Century (43 min)

My current books:

The Asian Heroine Who Seduced Me (Novel) print $10.95, Kindle $6.95 Read an excerpt for free (PDF)

When You Can’t Go On: Burnout, Numeration and Renewal $18 print, $8.95 Kindle ebook; audiobook Check out the very first section totally free (PDF)

Global Crisis, National Renewal: A (Revolutionary) Grand Technique for the United States (Kindle $9.95, print $24, audiobook) Check Out Chapter One for free (PDF).

A Hacker’s Teleology: Sharing the Wealth of Our Diminishing World (Kindle $8.95, print $20, audiobook $17.46) Read the very first section free of charge (PDF).

Will You Be Richer or Poorer?: Profit, Power, and AI in a Distressed World

(Kindle $5, print $10, audiobook) Check out the very first section totally free (PDF).

The Experiences of the Consulting Philosopher: The Disappearance of Drake (Unique) $4.95 Kindle, $10.95 print); checked out the first chapters free of charge (PDF)

Cash and Work Unchained $6.95 Kindle, $15 print) Read the very first area for free

End up being a $1/month patron of my work by means of patreon.com.

KEEP IN MIND: Contributions/subscriptions are acknowledged in the order received. Your name and e-mail stay personal and will not be given to any other private, company or agency.

|

Thank you, James N. ($50), for your incredibly generous contribution to this site– I am significantly honored by your assistance and readership. |

Thank you |

, Michael T. ($35), for yet another marvelously generous contribution to this website– I am significantly honored by your unfaltering support and readership. |

|

Thank you, Ciprian M. ($54), for your splendidly generous contribution to this site– I am greatly honored by your support and readership. |

Thank you |

, David W. ($40), for your magnificently generous contribution to this website– I am significantly honored by your assistance and readership. |