The worth of these super-abundant recklessness will trend rapidly to no as soon as margin calls and other little bits of reality significantly minimize demand.

Inflation, deflation, stagflation– they have actually all got proponents. However who’s going to be ideal? The difficulty here is that supply and demand are vibrant and so there are always things increasing in rate that haven’t altered materially (and are for that reason not worth the greater expense) and other things dropping in cost although they haven’t altered materially.

So proponents of inflation and deflation can always offer examples supporting their case. The stagflationist camp is happy to provide a compromise case: yes, there are both deflationary and inflationary dynamics, and what we have is the worst of both worlds: stagnant development and declining purchasing power.

What’s missing in most of these debates is a comparison of scale: deflationists indicate things like big-screen television prices dropping. OK, fine: we conserve $300 on a television that we may buy when every 2 or three years. So we save $100 a year thanks to this deflation.

Meanwhile, on the inflationary side, healthcare insurance coverage increased $3,000 a year, child care went up $3,000 a year, rent (or property taxes) increased $3,000 a year and look after an elderly moms and dad increased $3,000 a year: that’s $12,000. Now how many big-screen Televisions, substandard jeans, and so on that dropped a bit in cost will we have to buy to offset $12,000 in higher expenses?

This is the issue with abstractions like data: TVs dropped 20% in expense, while healthcare, childcare, helped living and rent all increased 20%– so these all balance out, right?

There are 2 glaring omissions in all the back-and-forth on inflation and deflation:

1. Price is set on the margins.

2. Enterprises can not lose cash for long therefore they shut down.

Let’s begin with an observation about the characteristics of price/cost: supply and demand. As a basic guideline, things that are limited and in high demand will go up in price, and things that are abundant and in low need will drop in cost.

Whatever is chronically limited and essential for life will have a ceaseless pressure to cost more, whatever is abundant and no longer preferable will have a ceaseless pressure to cost less.

Now we come to the neglected system # 1: Rate is set on the margins. Real estate provides an example: take a neighborhood of 100 houses. The five sales last year were all around $600,000, therefore appraisers set the value of the other 95 houses at $600,000.

Things alter and the next sale is at $450,000. This is dismissed as an outlier, however then the next 2 sales are likewise well below $500,000. By the fifth sale at $450,000, the worth of each of the 95 houses that did not alter hands has actually been reset to $450,000. The five houses that traded hands set the price of the 95 homes that didn’t alter hands. Cost is set on the margins.

The greatest cost in many business and agencies is labor. Those who own enterprises understand that it’s not just the wage being paid that matters, it’s the labor overhead: the advantages, insurance coverage and taxes paid on every staff member. These are often 50% or more of the wages being paid. These labor overhead expenditures have actually escalated for numerous business and companies, increasing their labor costs in ways that are concealed from the workers and public.

It is very important to recall that approximately 3/4 of all local government expenditures are for labor and labor overhead– health care, pensions, and so on. Where do you believe local taxes are heading as labor and labor-overhead costs rise? What takes place to pension funds when all the speculative bubbles all pop?

The expense of labor is likewise set on the margins. The wage of the 100-person workforce is set by the 5 most recent hires, and if earnings went up 20% to secure those employees, the cost of the labor of the other 95 employees also increased 20%. (Companies can conceal a mismatch however not for long, and such deception will push away the 95% who are making money less for doing the very same work.)

Labor is limited for fundamental factors that aren’t disappearing:

1. Demographics: big generation is retiring, replacements are not guaranteed.

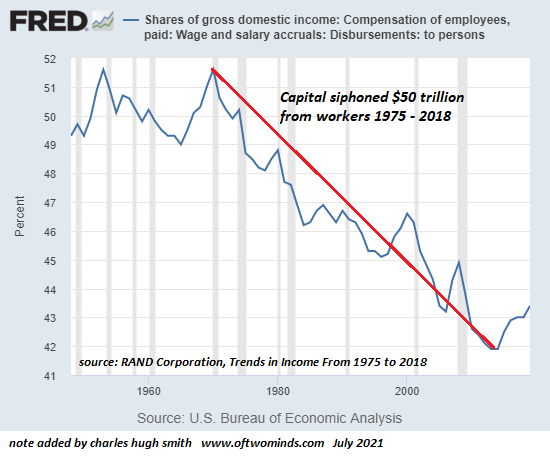

2. Catch-up: labor’s share of the economy has decreased for 45 years. Now it’s catch-up time.

3. Cultural shift in values: Antiwork, slow living, FIRE— all are manifestations of a profound cultural shift away from working for decades to pay financial obligations and enrich billionaires to downshifting costs and expectations in favor of leisure and firm (control of one’s work and life).

4. Long Covid and other persistent health issues: whether anybody cares to confess or not, Long Covid is real and inadequately tracked. A host of other persistent health problems arising from overwork, tension and unhealthy way of lives are likewise improperly tracked. All these decrease the supply of labor.

5. Competing demands of household and work. Work has actually won for 45 years, now household is pressing back.

Put these together– decreasing supply of labor and labor being priced on the margins– and you get a runaway freight train of higher labor expenses. Include runaway increases in labor overhead and you have actually got a runaway freight train with the throttle jammed to 11.

Deflationists make one fatally unrealistic assumption: that enterprises facing sharply greater costs for labor, components, shipping, taxes, etc will continue making big-screen TVs, shoddy jeans, and so on even as the rate the product or services fetch plunges below the expenses of producing them.

The wholesale rate of the television can’t drop below production and shipping costs for long. Then the makers shut down production and the over-abundance of Televisions, etc disappears. Nation-states can subsidize production of some things for a time, but costing a loss is not a long-lasting winning method: subsidizing failing enterprises and money-losing state-owned business is a type of malinvestment that bleeds the economy dry.

The only thing that will still be super-abundant as need plummets is phantom-wealth “financial investments”, i.e. skims, scams, bubbles and frauds. The value of these super-abundant follies will trend quickly to zero once margin calls and other littles truth dramatically lower demand.

Real-world expenses: much higher. Speculative gambles: much lower. As in absolutely no.

Thank you, everyone who dropped a hard-earned coin in my pleading bowl today— you reinforce my hope and refuel my spirits.

If you found value in this material, please join me in seeking solutions by becoming a $1/month customer of my work via patreon.com.

Current Videos/Podcasts:

Bit About Crypto Podcast – Charles Hugh Smith (58 min)

My current books:

A Hacker’s Teleology: Sharing the Wealth of Our Diminishing Planet (Kindle $8.95, print $20, audiobook $17.46) Read the first section totally free (PDF).

Will You Be Richer or Poorer?: Revenue, Power, and AI in a Traumatized World

(Kindle $5, print $10, audiobook) Read the first section free of charge (PDF).

Pathfinding our Destiny: Preventing the Last Fall of Our Democratic Republic ($5 (Kindle), $10 (print), ( audiobook): Read the first area totally free (PDF).

The Experiences of the Consulting Philosopher: The Disappearance of Drake $1.29 (Kindle), $8.95 (print); checked out the first chapters free of charge (PDF)

Money and Work Unchained $6.95 (Kindle), $15 (print) Read the very first area totally free (PDF).

Become a $1/month customer of my work by means of patreon.com.

KEEP IN MIND: Contributions/subscriptions are acknowledged in the order got. Your name and email stay private and will not be provided to any other individual, company or company.

|

Thank you, Gavin G. ($50), for your marvelously generous contribution to this site– I am significantly honored by your support and readership. |

Thank you |

, August M. ($20), for your much-appreciated generous contribution to this site– I am significantly honored by your support and readership. |

|

Thank you, Tim K. ($52), for your wonderfully generous contribution to this site– I am greatly honored by your assistance and readership. |

Thank you |

, Alex T. ($50), for your splendidly generous contribution to this site– I am greatly honored by your support and readership. |